ERM Solutions

A Common Sense, Cost Effective Approach to Risk Governance

ERM | Time for a New Approach

The current industry approach to corporate governance-ERM (enterprise risk management) is expensive, unnecessarily complex and in many instances ineffective, leaving many insurance executives dissatisfied with the results.

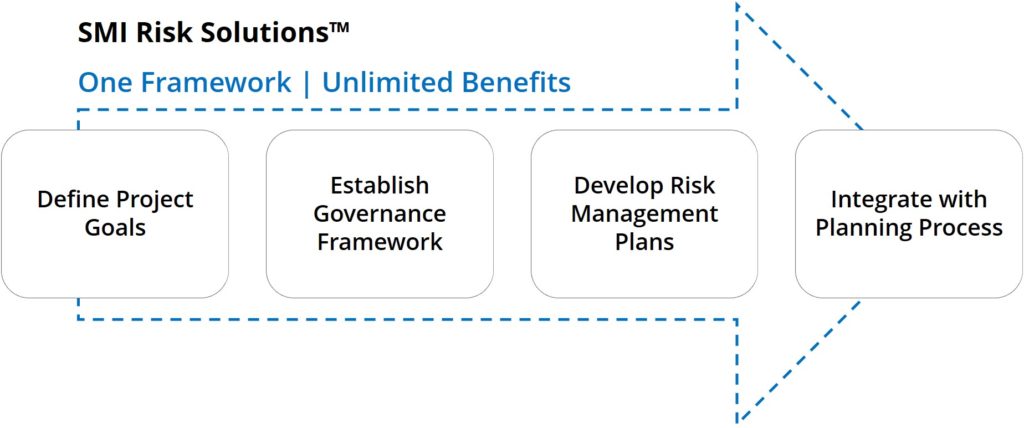

That’s why CTM Advisory created — SMI Risk Solutions™ — a common sense, cost effective approach to risk management designed specifically to help small to medium-sized insurers (SMIs) develop a risk governance framework that satisfies regulatory demands but also delivers value to the enterprise and its constituents.

The Untapped Benefits of ERM

SMI Risk Solutions™

ERM Solutions was launched in 2013 to support CTM’s Rating Advisory Services as ERM is an important component of the credit rating evaluation.

In 2015, CTM decided to broaden its service solution and began offering SMI Risk Solutions™, a new and more practical approach (see Exhibit above) to ERM that not only addresses potential regulatory and rating agency concerns but also helps insurers achieve other important organizational goals (see Untapped Benefits of ERM).

“The industry needs a fresh new approach to ERM. One that is workable and not based on some academic’s view of how risk should be managed.”

Contact us today for your FREE Consultation.