Risk Culture or Team Chemistry?

I have always held the view that business, much like sports, is a team game. The success, of which, largely depends on how well a team can work together (i.e., teamwork) to achieve a common goal.

In sports, we call this “teamwork or chemistry”. In the business world, we call it “culture or risk culture”, a term that has become increasingly associated with enterprise risk management. Yet achieving this type of risk culture (see our definition below) is no easy task especially when an organization has notable deficiencies in its 1) leadership, 2) strategy, 3) communications or 4) ability to hire (attract) capable individuals with similar values.

“Risk culture is a set of values — personality traits — shared by an organization, department or team that guides the attitudes and actions of its members.” — CTM Advisory

That’s why it’s very important for leaders within any organization to set the tone and to demonstrate for its employees (teammates) the kind of culture they want for the organization (team).

Risk Culture Example – A Tale of Two Players

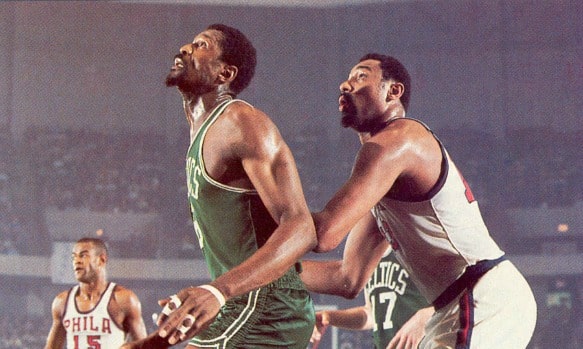

Let’s look at the legendary careers of Mr. Chamberlain and Mr. Russell to illustrate our point about the importance of leadership and risk culture (teamwork) to an organization.

Arguably both players were team leaders and among the best centers that ever played the game. Yet both players and their respective teams had a remarkably different approach to playing the game. These differences, not surprisingly, led to divergent outcomes.

Perhaps the essence of that difference was made clear in an interview involving Mr. Chamberlain and Mr. Russell. In that interview, Mr. Chamberlain essentially said and I paraphrase:

There was one major difference in the way Bill and I played the game. Bill’s strategy was to involve all his teammates and give his team multiple options (threats) to score whereas my teammates generally looked for me to score.

It’s easy to understand why Mr. Russell’s team won 11 NBA championships while the teams Mr. Chamberlain’s played for only won two. Both were great players and champions in their own way. Only one, however, created a culture that emphasized “teamwork” over individual achievement and allowed his team to consistently achieve their goal. Indeed, an investment in risk culture (team chemistry and teamwork) can be a game changer.

“No man will make a great leader who wants to do it all himself or get all the credit for doing it.”— Andrew Carnegie

Parting Thoughts | How We Can Help?

According to MarketsandMarkets, a market research and consulting firm, it expects the Enterprise Governance Risk and Compliance market to grow from $15.98 billion in 2015 to $31.77 billion by 2020.

That’s a remarkable trajectory but is the return on that investment really worth it? We believe it can be but not until organizations stop investing in overly complex models and processes that a) no one in the firm can understand but the few people who designed them and b) do little to inform management of its external commitments.

As we tried to illustrate in the example above, the most successful organizations invest in their employees (i.e., risk culture) because of the potential payoff.

That’s why CTM Advisory created — SMI Risk Solutions™ — a common sense, cost effective approach to risk management that helps small to medium-sized insurers (SMIs) develop a risk governance framework that succeeds in accomplishing the following objectives:

- Enhances rating outcomes (viewed favorably by the rating agencies)

- Gives currently EXEMPT insurers a “head start” on eventual mandatory regulatory (“ORSA”) compliance

- Adds rigor to the planning (decision-making) process

- Directs the allocation of resources (financial and intellectual)

- Creates a catalyst for making difficult but necessary organizational changes

As your adviser, we will help you develop a risk governance framework that a) supports your strategy and risk culture, b) integrates well into your planning process — not its own separate discipline and c) satisfies regulatory requirements and rating agency expectations.

About CTM Advisory

CTM Enterprise Risk Advisers (“CTM Advisory”) is a Massachusetts based consulting group that provides credit rating and risk management support services to C-Suite insurance executives. All of our services are designed to help insurers achieve their credit rating goals. For more information about our services, please contact us.

Tell Us What You Think?

Did you find the content and subject matter of this post interesting? Please share with us your feedback and follow us for more great news on how to more effectively manage issues surrounding insurer credit ratings and enterprise risk management.