What is RORAC?

RORAC or return on risk adjusted capital is the ratio of reported net income to risk adjusted capital (i.e., required capital). It is one of many analytical tools that decision-makers can use to evaluate the risk-return characteristics of different investment opportunities on a consistent basis using historical or projected results.

The denominator of the formula, risk adjusted capital, is defined as the minimum amount of capital that an insurer must hold to support the risks (i.e., asset, insurance, credit, etc.) of a particular investment. Note an insurer’s minimum capital requirements are typically determined by insurance regulators and/or rating agencies (see section on Why Use BCAR to Approximate Risk Adjusted Capital?).

Why Regulators and Rating Agencies Shy Away from ROE?

Return on equity (ROE) is widely accepted by investors as a core measure of a company’s profitability. Insurance regulators and rating agencies, however, are less sanguine regarding the usefulness of this metric primarily because it fails to take into consideration the over or under capitalization of an organization which makes comparison to peers difficult.

RORAC | An Illustrative Example

The purpose of this example is to demonstrate to the reader the potential value of RORAC to the planning process. It is not meant to be comprehensive in its analysis but illustrative of how this tool, as part of a well-structured risk governance program, can help inform decision-making about which risk to take.

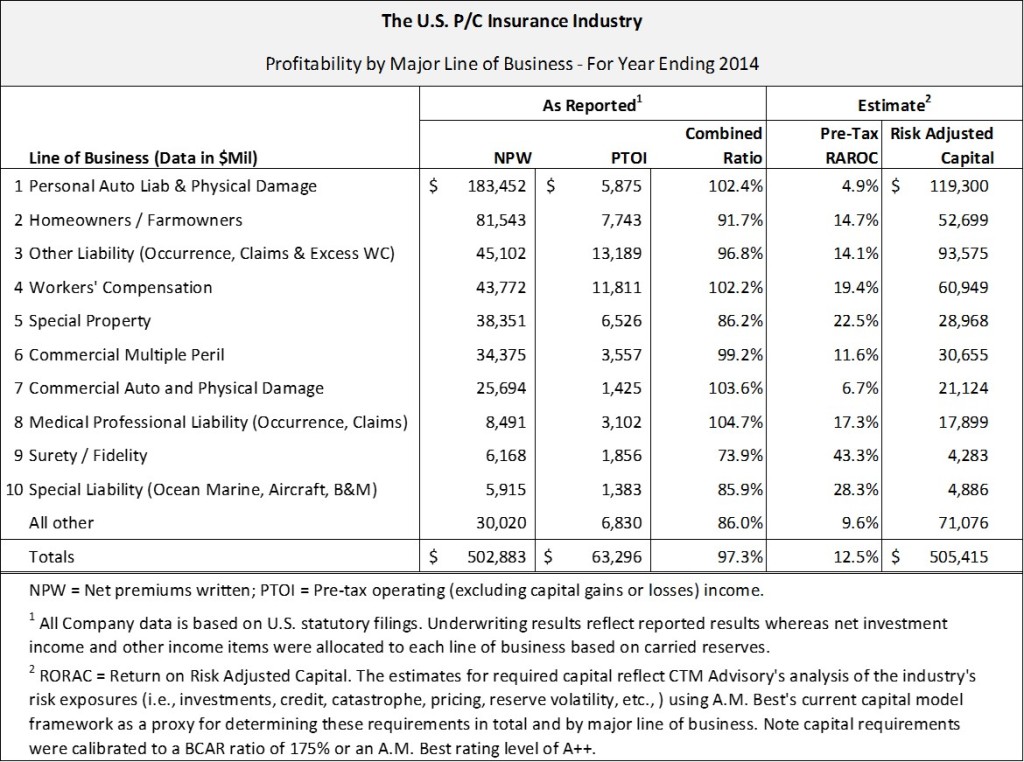

The table below shows the U.S. P/C Insurance Industry profitability in total and by major line of business for year-end 2014. Note all reported results are based on U.S. statutory financials, unless otherwise noted. Further, no adjustments were made to reported income for potential reserve deficiencies/redundancies or to normalize catastrophe losses but arguably those adjustments should be considered as part of any organization’s comprehensive planning process.

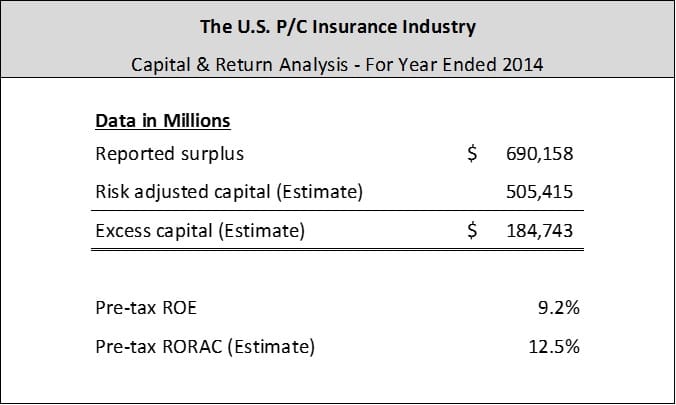

Not surprisingly, the industry’s profitability, as measured by RORAC, is higher than its published ROE as most industry experts agree that the P/C industry is overcapitalized (see table following). We note that if we adjust the RORAC calculation to remove excess capital, the ratio decreases to approximately 11.2% which is still higher than the industry’s ROE.

Methodology Used to Approximate Risk Adjusted Capital

Our calculation of risk adjusted capital was determined using A.M. Best’s current capital adequacy ratio (BCAR) assumptions and methodology and was calibrated to a BCAR ratio guideline of 175% or an A.M. Best rating level of A++(Superior). We chose the A++ rating level for its conservatism and because any viable and successful economic system needs to have a strong financial services sector to support it.

Note A.M. Best is in the process of updating its BCAR model (see article FAQ | New A.M. Best BCAR Model) which is expected to be released sometime later in the first quarter of 2016.

Why Use BCAR to Approximate Risk Adjusted Capital?

Admittedly, we could have used a number of methodologies (see article Risk Management: Time for an Honest Appraisal) to estimate risk adjusted capital including our own. We, however, chose the A.M. Best BCAR methodology because of its relevance and importance to the ratings and capital management strategies of most U.S. Property and Casualty insurers.

Parting Thoughts | Time for a New Approach

The current industry approach to risk management is expensive and in many instances ineffective, leaving many insurance executives dissatisfied (see our blog ViewPoints – Risk Management: Time for an Honest Appraisal).

That’s why CTM Advisory created — SMI Risk Solutions™ — a common sense, cost effective approach to risk management that helps small to medium-sized insurers (SMIs) develop a risk governance framework that succeeds in accomplishing the following objectives:

- Enhances rating outcomes (viewed favorably by rating agencies)

- Gives currently EXEMPT insurers a “head start” on eventual mandatory regulatory (“ORSA”) compliance

- Adds rigor to the planning (decision-making) process

- Directs the allocation of resources (financial and intellectual)

- Creates a catalyst for making difficult but necessary organizational changes

As your adviser, we will help you develop a risk governance framework that a) supports your strategy and risk culture, b) integrates well into your planning process — not its own separate discipline and c) satisfies regulatory requirements and rating agency expectations.

About Us

CTM Enterprise Risk Advisers (“CTM Advisory”) is a Massachusetts based consulting group that provides credit rating and risk management support services to C-Suite insurance executives. All of our services are designed to fulfill our mission of helping insurers achieve their credit rating and risk management goals.

For more information about our services, please contact us.

Tell Us What You Think?

Did you find the content and subject matter of this post interesting? Please share with us your feedback and follow us for more great news on how to more effectively manage issues surrounding insurer credit ratings and enterprise risk management.