The content in this post is provided by CTM Advisory and subject to the following Terms and Conditions.

Is AM Best updating its BCAR model?

Yes. A.M. Best (“BEST”) is in the process of updating its property-casualty (P/C) insurance capital adequacy model called Best’s Capital Adequacy Ratio (“BCAR”).

In its October 21, 2015 webinar update (A.M. Best Panel Reviews and Updates Capital Model Developments), BEST indicated that it expects to release for public comment a DRAFT of the new P/C BCAR criteria (Phase 1) and credit rating methodology (“BCRM”) sometime in the first quarter of 2016.

Concurrently, rated entities are expected to receive from BEST 1) a copy of the new model output using 2014 Company data and 2) preliminary guidance on how the new BCAR model score will inform BEST’s view of an insurer’s capital adequacy (i.e., balance sheet strength) and ultimately its rating.

Why are they changing the model?

It’s a good question. Arguably the current model, in our opinion, was effective in providing the analyst and other constituents with a reasonable assessment of an insurer’s capital adequacy (i.e., comparing an insurer’s available capital to the risks it assumes). A.M. Best, however, decided it was time to take advantage of more advanced modeling techniques to help them better understand and assess the risks (i.e., asset, insurance, etc.) facing an insurer.

We note, however, that the benefits (improved modeling techniques and risk assessment capabilities) of implementing these model changes may come at the expense of transparency as insurer’s may find it difficult to replicate the model for their own internal planning purposes.

Insurers should Contact CTM Advisory for advice on how to more effectively manage this very important change in the A.M. Best rating methodology.

What exactly is changing?

A.M. Best is planning to update the new model in phases. In Phase 1 of the new BCAR model roll out, we expect the following changes:

- Newly developed risk (capital) factors using stochastic simulations (~10,000) from probability curves

- A new diversification benefit (credit) for premium and reserve risk calculated using correlations matrices and adjusted for the Company’s size (4 categories)

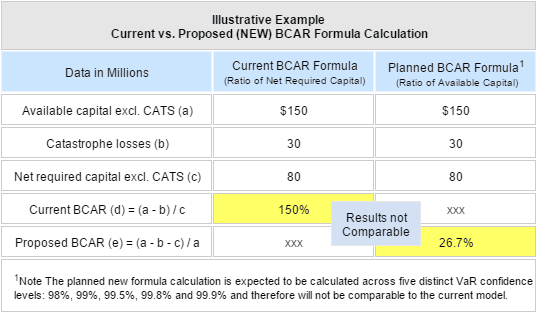

- A new BCAR formula (the ratio of excess capital to available capital) is expected to replace the current ratio of available capital to net required capital

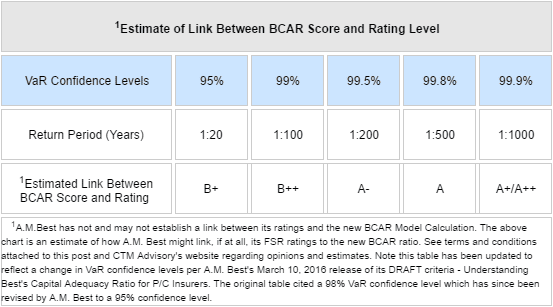

- The new BCAR formula will be calculated at five distinct VaR confidence levels (95%, 99%, 99.5%, 99.8% and 99.9%) instead of one ratio (current model). Note the original article cited a VaR of 98%. Since the release of this article, A.M. Best has released a more current DRAFT of its proposed BCAR methodology which revised the 98% confidence level to 95%.

Note the original plan for the Phase 1 roll out did not contemplate a change in the BCAR model formula. Further, catastrophe risk will be added to net required capital (NRC) instead of a deduction to available capital.

Phase 2 adjustments (i.e., co-variance – square root rule) to the P/C model are covered later in this article.

When did BEST decide to change the BCAR formula?

In its October 21, 2015 Webinar Update, A.M. Best announced that it plans to change the BCAR model formula (see Example below) from a ratio of net required capital (available capital as a % of net required capital) to a ratio of available capital (excess capital as a % of available capital).

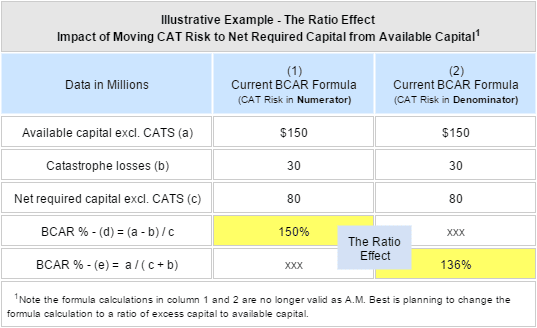

The decision to change the BCAR formula (see above) was not surprising given an earlier announcement by BEST that it was moving the adjustment for catastrophe risk (“CATS”) from the numerator (i.e., a deduction to available capital) of the formula to the denominator (i.e., an addition to net required capital).

BEST made the right decision because under the current (soon to be old) formula CAT exposed insurers would have been penalized by what we call the “ratio effect” (see Example below) not an actual change in exposure.

How will these changes impact an insurer’s BCAR score?

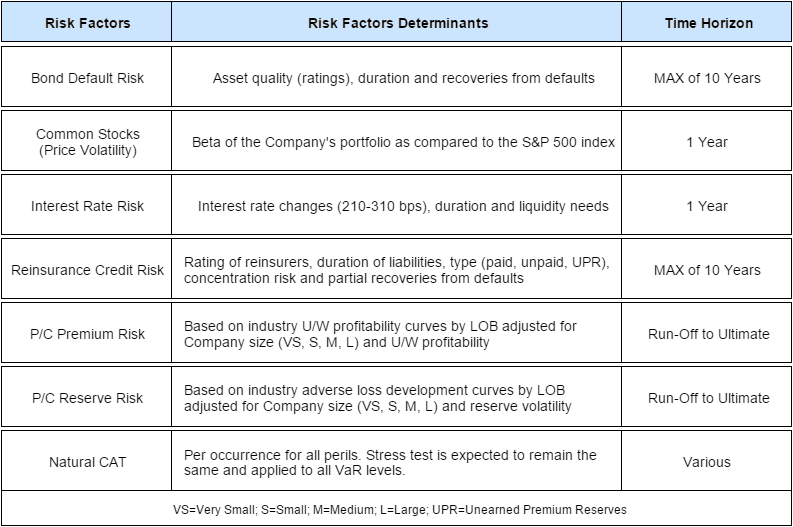

BEST expects its new methodology for estimating the various risk factors (see Table below), including its decision to measure risk across five distinct VaR confidence levels, to generate higher risk (capital) charges and therefore lower BCAR scores.

Investment risk charges (both bond defaults and common stock price volatility) are expected to increase in the new model. The increase in the bond default charge reflects a more in depth look at asset quality (ratings) for Class 1 and 2 bonds and bond duration and more recent data on bond defaults. Similarly, the risk charge for common stocks is expected to more than double (at the 98% VaR confidence Level) from the 15% static risk charge used in the current BCAR model.

Note A.M. Best tested the impact of these new investment risk charges on its universe of rated entities and not surprisingly the impact to BCAR scores was immaterial. However, that test did not contemplate a change in the current co- variance adjustment (the square root rule) which A.M. Best expects to address as part of its Phase 2 model update. We expect any adjustment to the co-variance formula to result in an increase in an insurer’s net required capital.

Interest rate risk charges will be higher as well. A.M. Best is measuring an insurer’s exposure to a one year rise in interest rates. The new assumption reflects a one year change in interest rates between 210 bps (98% VaR) and 310 bps (99.9% VaR) versus 120 bps under the current model.

Reinsurance risk charges are expected to be higher than under the current model and will include an adjustment to account for concentration (reinsurer dependence) risk. We expect this change to have a more adverse impact on smaller insurers as they generally cede business to a limited number of reinsurers. A.M. Best has said it expects to address this issue quantitatively and qualitatively in its rating review.

P/C premium and reserve risk line of business charges are expected to be higher. However, certain lines like personal auto are expected to have lower risk charges due to lower volatility. Moreover, the risk charge for property lines have been adjusted to remove catastrophe risk as to avoid double counting of the catastrophe charge.

The diversification benefit for reserve and premium lines of business risk will be calculated using correlation matrices instead of the largest line of business. We, therefore, expect the benefit to be less than under the current model. Further, BEST observed that liability lines tend to move together whereas property lines have no correlation with liability lines. The net impact of this change is that reserve risk is expected to receive less diversification benefit because of 1) the lack of independence between liability lines and 2) property reserves generally make up a smaller proportion of total reserves. Premium risk, however, is expected to receive more diversification benefit than reserve risk but less than under the current model.

Will credit ratings change?

A.M. Best says it does not expect “sweeping” changes in industry ratings because of the model update. However, it did not rule out changes to individual Company ratings. We believe and A.M. Best has publicly stated that insurers with disproportional risk exposures (e.g., above average stock market exposure) may face increased ratings pressure with the roll out of the new model. In those instances, we would expect A.M. Best to place the insurer’s rating under review with negative implications.

Insurers should Contact CTM Advisory for advice on how to more effectively manage this very important change in the A.M. Best rating methodology.

Will the previous BCAR guidelines change?

Yes. Once A.M. Best made the decision to change the BCAR formula calculation, the previous BCAR guidelines that linked rating levels to specific BCAR scores became invalid. We expect BEST with the release of its DRAFT BCAR and BCRM criteria in the first quarter of 2016 to provide explicit guidance on how the new model scores will link up with rating levels. Until such time, we are providing our own estimate (see Table below) of how BEST might link the new BCAR model scores to the various rating levels.

How important is BCAR to the Rating Evaluation?

This question was specifically addressed by BEST in the three webinars it held on this topic in 2015. The answer — BCAR is just one factor that BEST considers in its evaluation of balance sheet strength and the final rating (see quote below). Hence the reason why BEST is updating its P/C credit rating methodology (BCRM).

The GAP between the real and perceived role of BCAR and how BCAR fits in our rating evaluation must be closed and we are addressing that in our credit rating methodology (BCRM).

— A.M. BEST, Oct. 2015 BCAR Webinar Update

BEST, with the roll our of its new BCAR model criteria and BCRM, expects to dispel the myth than an insurer’s rating is equal to its BCAR score. Indeed, BCAR (one factor that approximates balance sheet strength) is an important rating factor but so is an insurer’s operating performance, business profile and risk management capabilities. To illustrate, let’s examine the example of Progressive Corp. According to A.M. Best, Progressive’s capitalization is just adequate yet it received a rating of (A+/Superior) because of its consistently strong operating performance and sustainable competitive advantages (see Press Release).

BEST also makes the point that capitalization, as measured by its BCAR model, is currently not a driver of industry ratings. We agree. The P/C industry by any measure is overcapitalized and therefore capital (BCAR) is not a particularly useful data point in differentiating financial strength. We, however, note that underwriting and economics conditions do change and so do the factors that drive ratings. We, therefore, caution insurers from discounting the importance of BCAR in the rating analysis.

What model changes should we expect in Phase 2?

A.M. Best has indicated that the Phase 2 roll out of the model will address remaining asset classes, life and annuity risks (mortality, longevity, product guarantees, disintermediation and long-term care and disability) and the co-variance adjustment (the square root rule or diversification benefit) used to calculate net required capital. The latter is expected to be replaced by a correlation matrix which by itself may significantly increase an insurer’s net required capital.

How can CTM Advisory help?

CTM Enterprise Risk Advisers (“CTM Advisory”) is a Massachusetts based consulting group that provides credit rating and risk management support services to C-Suite insurance executives. All of our services are designed to help insurers achieve their credit rating goals.

For more information about our services, please contact us at the link below or visit us our website.

Tell Us What You Think?

Did you find the content and subject matter of this post interesting? Please share with us your feedback and follow us for more great news on how to more effectively manage issues surrounding insurer credit ratings and enterprise risk management.