Strategies for Higher Credit Ratings

Why are some insurers more successful than others in achieving their credit rating goals?

- Strong performance,

- Good working relationship with lead analyst and/or rating committee members

Obviously those are important considerations but our experience has taught us that the most successful companies follow three basic strategies:

- Make their rating objective a top organizational priority,

- Develop a credible business plan to achieve that objective and

- Proactively address rating obstacles.

How can CTM Advisory help?

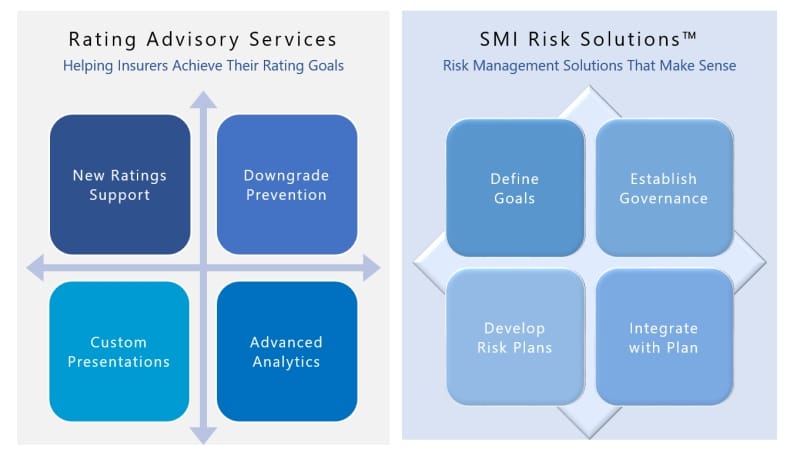

At CTM Advisory, we understand the importance of ratings to the success of your business. Whether your company is 1) new to the rating process, 2) facing a ratings downgrade or 3) just simply looking to improve its current ratings, we have the technical expertise and service solutions that can help your organization develop and implement a plan to achieve its rating goal.

The Source of Our Success

We have more than 20 years of rating agency experience (see Testimonials), both as an insider (former Director of S&P Insurance Ratings) and an outsider (former Head of Rating Agency Management) and the strategies that can help your organization succeed in achieving its credit rating goals.

Our success is a function of our values (see P-E-R-C-S™ below) and defined by how we approach each customer engagement.

- Preparedness: We adhere to the old adage that “an ounce of prevention is worth a pound of cure.” That’s why our customers are prepared for virtually any challenge.

- Experience: Few consulting groups can claim to have more than 20 years of rating agency experience as BOTH an insider and anoutsider. We can.

- Relationships: We endeavor to build long-term, productive relationships with our customers, partners and associates.

- Commitment: We are tireless in our pursuit of excellence because any worthwhile goal is worth the struggle and effort of obtaining it.

- Service: We place the interests of our customers first and work hard to exceed their expectations.

About Us

CTM Enterprise Risk Advisers (“CTM Advisory”) is a Massachusetts based consulting group that provides credit rating and risk management support services to C-Suite insurance executives. All of our services are designed to fulfill our mission of helping insurers achieve their credit rating and risk management goals.

For more information about our services, please contact us at the link below or visit us our website.

Tell Us What You Think?

Did you find the content and subject matter of this post interesting? Please share with us your feedback and follow us for more great news on how to more effectively manage issues surrounding insurer credit ratings and enterprise risk management.